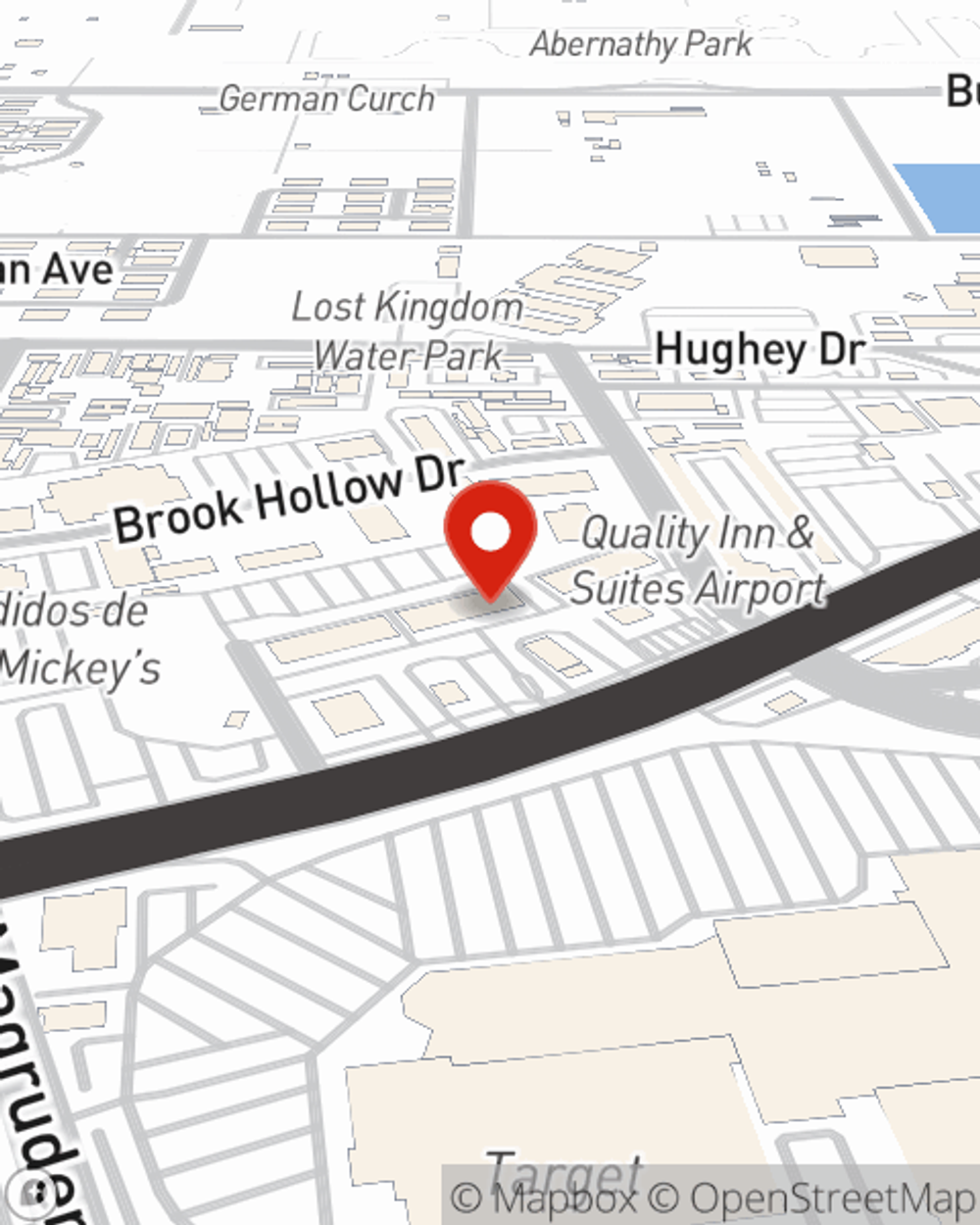

Business Insurance in and around El Paso

El Paso! Look no further for small business insurance.

Cover all the bases for your small business

- EL Paso, Texas

- Sunland Park, NM

- Santa Teresa, NM

- Horizon City, NM

- Texas

- New Mexico

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to consider. We get it. State Farm agent Jacobo Akle is a business owner, too. Let Jacobo Akle help you make sure that your business is properly insured. You won't regret it!

El Paso! Look no further for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your pay, but also helps with regular payroll expenditures. You can also include liability, which is important coverage protecting you in the event of a claim or judgment against you by a visitor.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Reach out to State Farm agent Jacobo Akle's team today with any questions you may have.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jacobo Akle

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?